Saving money is not always easy, especially when you’re just starting. That’s why we need to strategise and find ways to help us be able to save. If you’re looking for strategies you can use to save money, then read and understand what ipon challenge is and see if you can find interesting ways you can use to save money.

Now if you understand how important saving money is and have decided to get started, then you can also check out some of our tips on saving money.

We’ve listed some of the Ipon challenge you can try to achieve some of your saving goals by the end of the year.

What is “Ipon Challenge”?

Ipon challenge is a money-saving challenge that can help you achieve your savings goals. Ipon challenges are helpful because you have a guide you can follow to help you focus on achieving your goals.

Ipon challenges should help put the fun into saving money. We must admit that saving money is not easy, so we have to find ways to put fun into it, like doing it with a friend or with your office mates.

If you’re up to a challenge, read our ipon challenges and find out the best one to use, depending on different factors.

10 Money Saving Challenges You Can Try

Here are our ten ipon challenge you can start doing to be able to start saving money. You can do a combination of 2 or 3 of these challenges and see how much you’ll be able to save in one year.

1. 52-Week Ipon Challenge

The 52-Week Ipon Challenge is a way of saving money by starting with a certain amount and adding the same amount every week to increase your savings. This challenge can help you to get into the habit of saving and gradually increase the amount you will save.

Pros:

- You’ll start with a low amount, so it’s not so hard to get started with this.

- You can choose an amount you are comfortable to start saving. Make sure you can commit to saving this amount weekly.

Cons:

- The amount will gradually increase, and it might be harder to commit to it towards the end.

- It’s a weekly saving plan, which may not be applicable for people who receive their pay bi-monthly or monthly.

How to do it:

- You can get a container, which can be a clean can or a bottle, where you can put in your weekly savings.

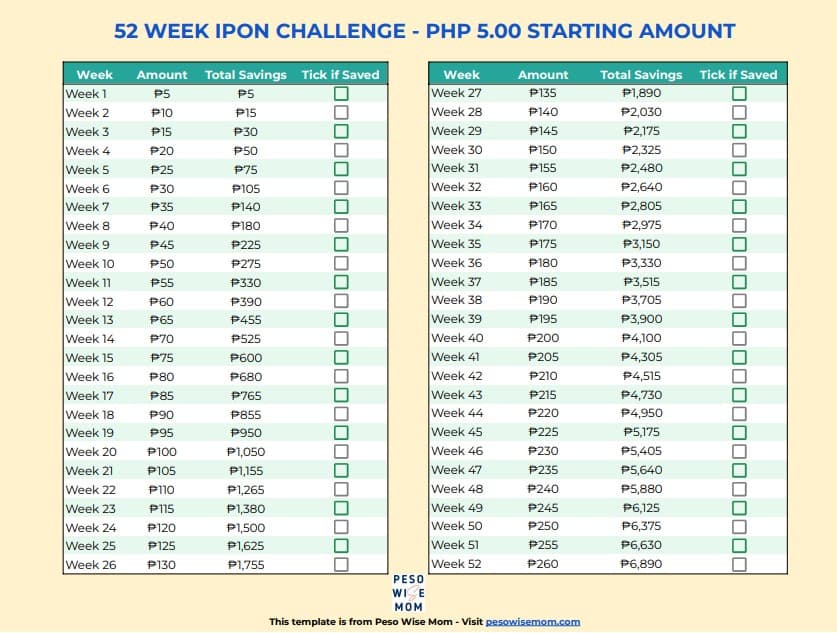

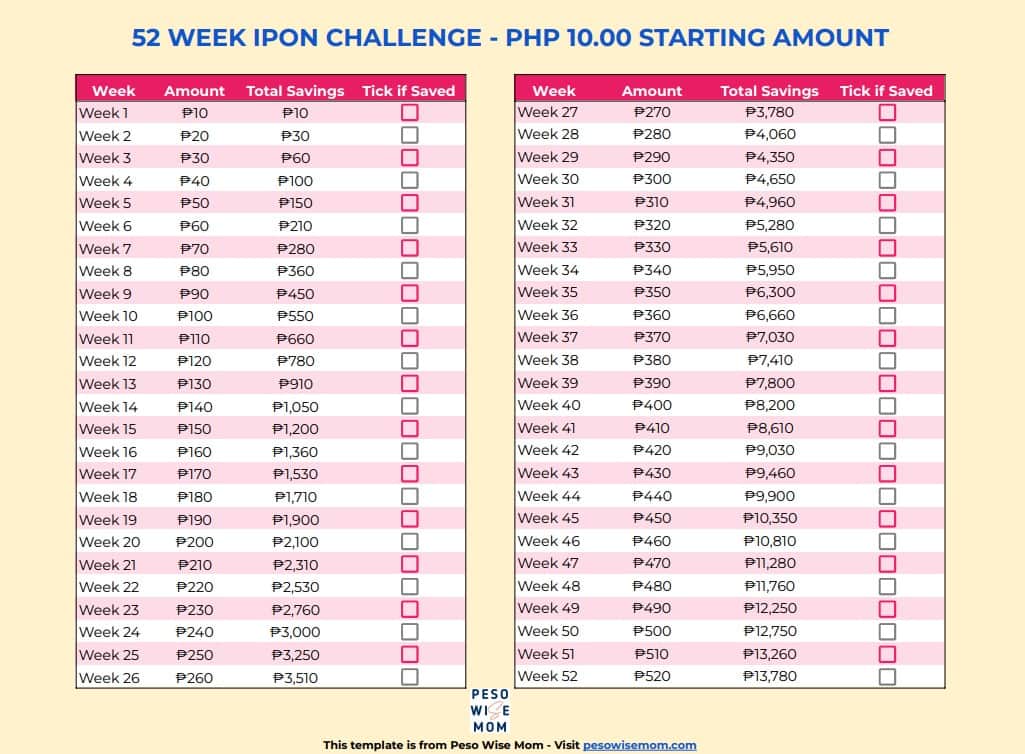

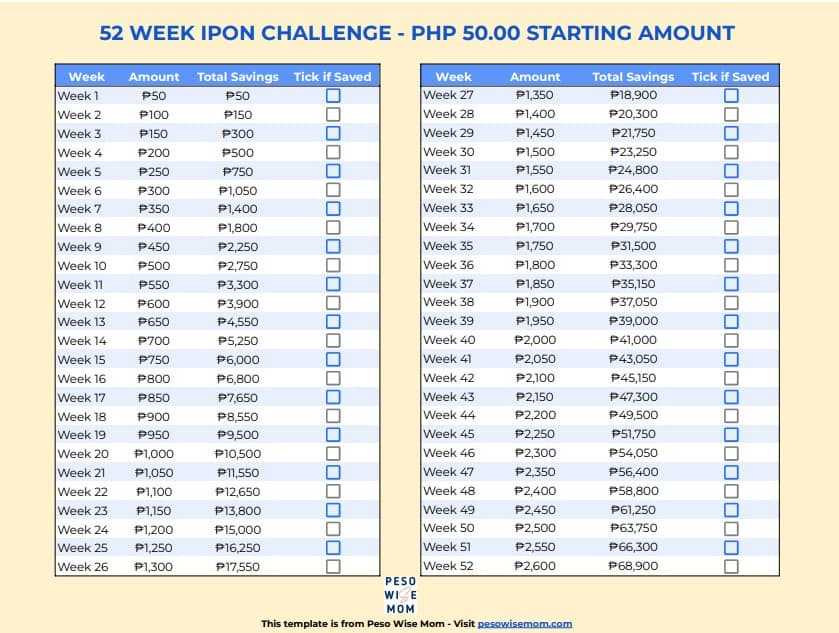

- Decide how much you would like to save. Refer to the table below to check out the total amount you can save depending on the amount you chose.

- Based on the total amount listed below. Think about a goal you would want to save for and purchase by the end of the year. Doing this will help you be motivated and continue with this saving challenge no matter what happens.

- You have to make sure you can commit to the amount. Check out the weekly amount you need to save in the image below, and make sure you can commit to the amount towards the end of the saving challenge.

- You Can print out the PDF form and mark the weekly amount once you are able to save it already. This way, you can keep track of your savings as well.

Here’s a table showing the total amount of savings you can have if you start with a certain amount.

| Starting Amount | Total Saving by the End of the Year |

| Php 5.00 | Php 6, 890.00 |

| Php 10.00 | Php 13, 780.00 |

| Php 20.00 | Php 27, 560.00 |

| Php 50.00 | Php 68, 900.00 |

| Php 100.00 | Php 137, 800.00 |

Download 52-Week Ipon Challenge Trackers

Check out our downloadable PDFs for you to use if you choose to give this challenge a try.

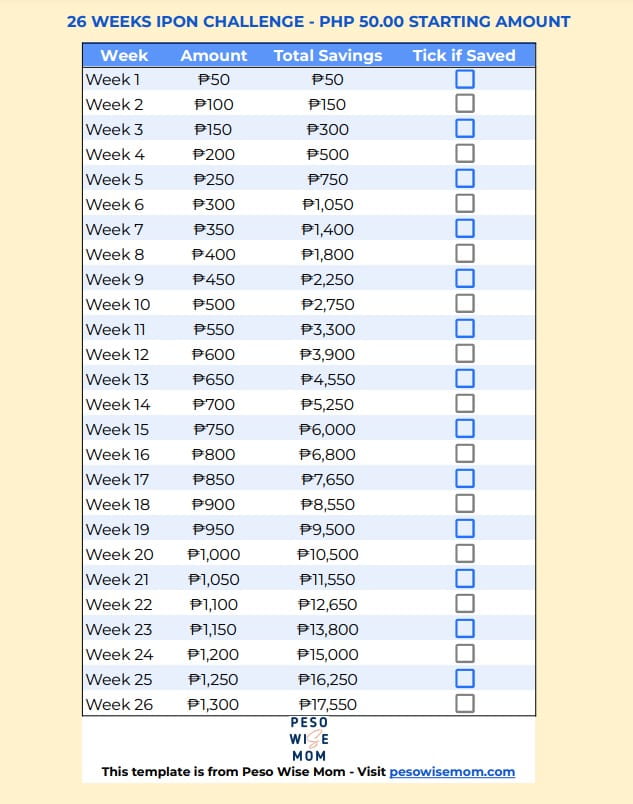

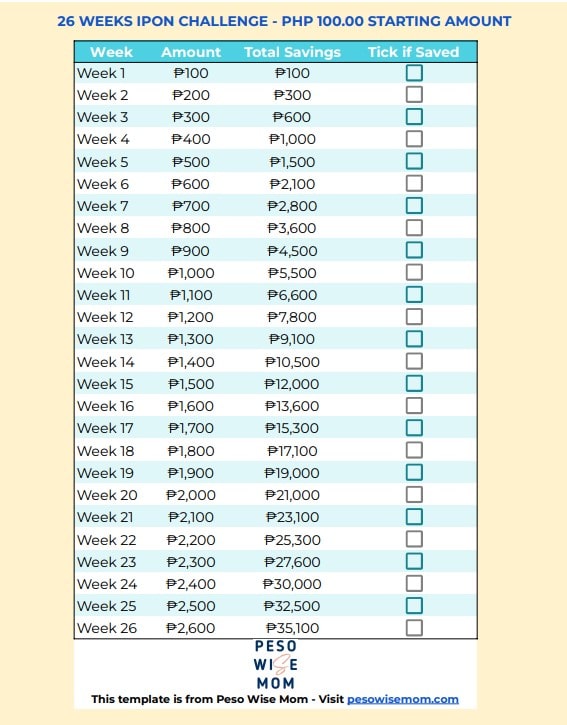

2. 26 Weeks Bi-weekly Saving Challenge

The 26 Weeks savings Challenge is the same as the 52 Weeks Saving Challenge, but this time you’ll be doing it bi-weekly instead. This challenge is best for people who are getting their pay bi-weekly.

Pros:

- The amount is increasing, so you can adjust your budget as the months’ progress.

- This can be flexible, and you can start with a lower amount if you wish to follow this saving challenge.

Cons:

- It will gradually increase, and the amount in later months will be higher.

- This is not for people who are receiving their pay on a monthly basis.

How to do it:

- Get a container, which can be a clean can or a bottle, where you can put in your bi-weekly savings.

- Check the downloadable template below and see which one you might want to use.

- Just add the same amount to your biweekly schedule to be able to compute the amount you have to save.

- Mark the box once you’re able to save the indicated amount.

Download 52-Week Ipon Challenge Trackers

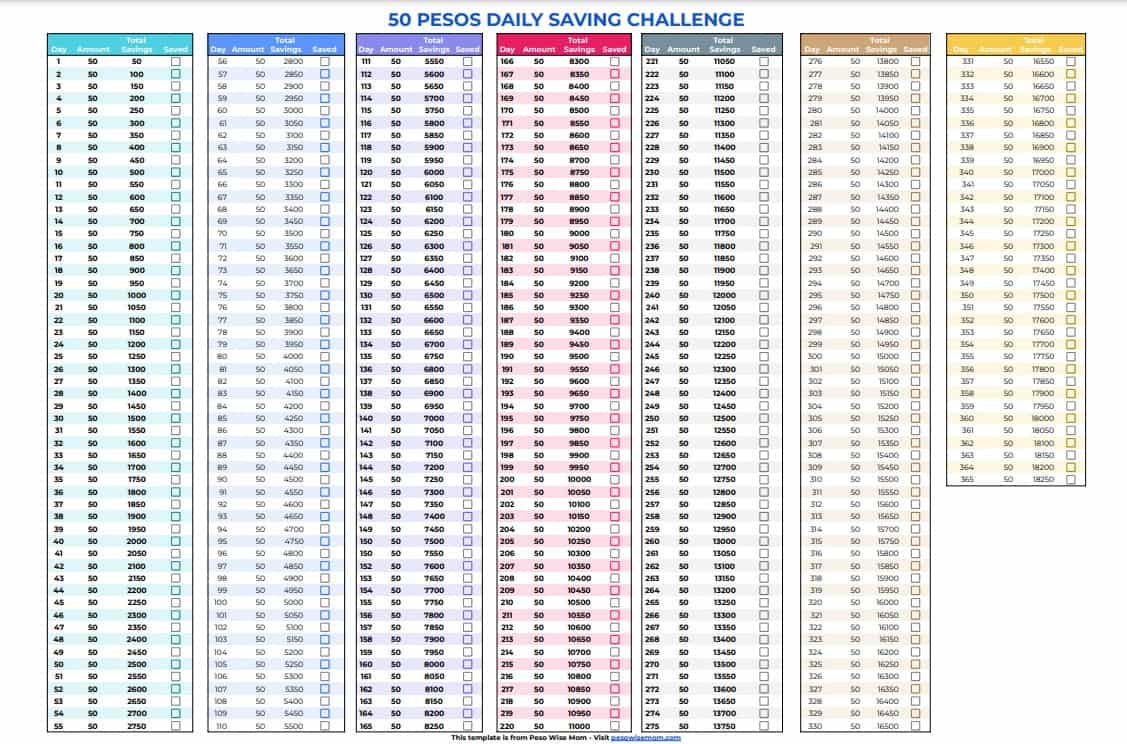

3. 50 Pesos Daily Challenge

The 50 Pesos Daily Challenge simply keeps 50 pesos of your daily income. This challenge can also be 50 pesos daily from your allowance, so students can participate to this challenge.

Pros:

- This is an easier option because you already know how much you are going to save. You will also do this daily, so you will just be mindful of doing it every day until the end of the year.

- This applies to all, including students who have a daily allowance.

- This is also helpful for people who are getting paid daily.

Cons:

- It may be more challenging for people receiving their pay monthly or bi-monthly.

- The total savings by the end of the year may not be that much compared to other money-saving challenges.

How to Do it.

- Prepare a can or a clean bottle. You can also use boxes for this if you’re just going to use 50 pesos paper bills.

- Be mindful of the amount and keep it immediately once you receive your daily pay or allowance. For store owners or vendors, remember to keep 50 pesos and save it immediately at the end of the day.

If you want to keep track of your daily savings, you can download and print this PDF form to mark it once you were able to save for the day. You will also know if you miss a day, you can just double the amount you will save the next day and mark both days.

50 Pesos daily saving challenge Downloadable PDF

4. Coffee Break Saving Challenge

This challenge is specially designed for coffee lovers, but this doesn’t mean you’ll stop drinking coffee. This challenge is for people who buy coffee more than they should in a day from coffee shops that are worth P130 pesos or more. Some people also buy expensive coffee for the sake of social status.

You can also apply this for milk tea or other expensive drinks you usually buy daily.

You can probably think about making your coffee at home and saving the amount instead.

If you’re buying once daily, you can try and make it thrice per week and save the other days instead and see how much you can save.

You can use this tracker if you’re up to this challenge and start saving from your coffee budget.

Here’s a fun coffee challenge tracker you can use.

Coffee Saving Challenge Tracker – Downloadable PDF

5. No Soda, No Alcohol challenge

Hmmm, we’re talking about Soda and Alcohol this time.

If you’re a person who’s so addicted to drinking soda or alcohol. Try and think about how much you’ll save if you cut down on buying these.

Pros:

- You’ll get healthier, as too much soda and alcohol are not good for your body.

- You can combine this with other saving money challenges in order to achieve your financial goals faster.

Cons:

This can be very challenging for people who are already addicted to it, so take it slow and make sure you have a savings goal that will make you want to stop and trade this addiction.

How to do it:

- Think of a goal you want to achieve through saving. As mentioned above, it should be a goal that can make you trade your addiction.

- Find a clean can or a bottle you can use to put the money you save daily.

- Print the PDF below and mark a bottle every time you’re able to resist buying and choose to save the amount instead.

Soda/ Alcohol Challenge Downloadable PDF

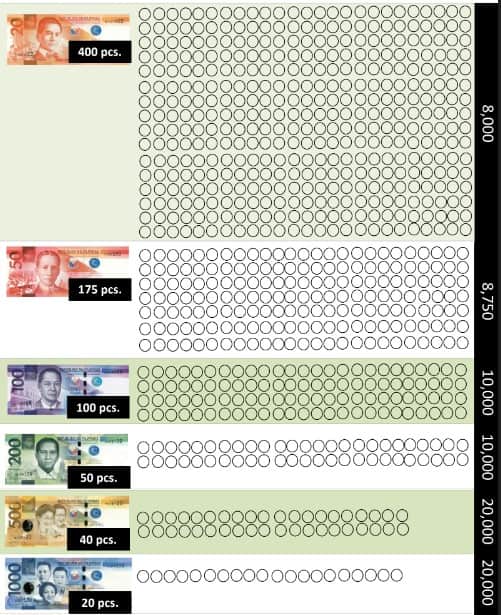

6. Peso Sense Ipon Challenge

This challenge is from peso sense. It’s a straightforward challenge. You just have to shade each time you put the amount in your saving bottle or can.

Pros:

- No Time pressure. Every time you have an extra amount, you can just put it inside and shade the amount you saved.

- You can start completing the smaller bills. As for the bigger bills, you can set a time to do it. You can set it every payday or every time you have an extra 500 or 1000 bill.

- You can set how many months you would like to complete this and then restart once you are able to complete the first one so you can have more savings for a year.

Cons:

- You might have a hard time completing the bigger bills, which may hinder you from continuing the challenge.

- It’s not time-bound, so you won’t be obliged to do it. That’s why it’s advisable also to set a completion date for this challenge.

How to do it:

- Find a can where you can paste the tracker.

- Print out the tracker and shade under the amount every time you’re able to save.

- Complete shading all the dots, and you’ll be able to complete P60,000 pesos in no time.

Peso Sense Ipon Challenge Template

7. No Spend Challenge or No Eating Out Challenge

So what is this no-spend challenge?

Does it mean you’re not going to spend at all?

It’s not that extreme. This challenge just means you’ll think of something you would want not to spend on.

For example, if you spend a lot during weekends, you can set a no spend Challenge every weekend. So if you’re going out or eating out on weekends.

You can challenge yourself to plan something you can do at home and cook instead. That way, you can save the amount budgeted for that day.

You can also do a no-spend challenge for your groceries. Do not go to the grocery store until you have already finished all your stocks in your pantry. This way, you can also avoid having spoiled food.

Pros:

- You can do this challenge with your whole family, which can be fun.

- This is very flexible, and you can decide on what kind of challenge you want to do for yourself.

Cons:

- It might be hard to think about a challenge to do.

- No fixed amount on how much you can save, so it can be hard to figure out how much you will set aside for your savings.

How to do it:

- Think of an activity you usually spend a lot of money on.

- If you’re married, explain this challenge to your spouse and family members and let everyone be aware of the challenge. Let them participate in any other NO-spend challenge ideas as well.

- Think of a saving goal you would want to achieve.

- You can save the amount in your savings account.

- Use our tracker below to keep track of your savings and see how much you can save with this challenge.

No Eating Out Challenge – Downloadable PDF

8. Bonus Challenge

Bonus challenge is simply saving every bonus you get. If you don’t get bonuses, you can make this an incentive or Overtime challenge. Others may be getting allowances or tip. You can challenge yourself and save anything you receive extra.

Pros:

- You won’t be able to notice you’re able to save money by the end of the year because you’re just living with your salary.

- You will be able to avoid spending on unnecessary things because of the unexpected amount you just received.

Cons:

- If you’re not regularly receiving any bonus or overtime pay, your savings will not be that much at the end of the year.

How to do it:

If you’re receiving your pay through your bank, save the extra amount immediately. You can transfer it to another savings account you may have set up.

If you are receiving it as cash. Set it aside immediately. Find a place where you can safely keep your extra pay.

9. Invisible Money Challenge

This is a challenge you might want to try. The invisible money challenge means treating a certain amount as invisible for a year or a couple of months. For example, if you treat a 200 peso bill as invisible, then every time you receive one, you have to keep it instead of spending it.

Pros:

- You can do this without any pressure of needing to complete a certain amount in a week or a month.

- You can save some amount at the end of the year.

Cons:

- You will have to compromise if it’s your only bill.

- Your savings will depend on how many times you’ll get that certain bill, so you might not be able to target a savings goal with this strategy.

How to do it:

- Have a place where you will keep your invisible bill. You can put it in a wallet or a bottle. Just make sure you’ll keep it in a safe place.

- Decide on a bill you will treat to be invisible. It can be a 50 peso bill or a 200 peso bill.

- Always be mindful that you will always treat the amount as invisible and should go directly to your savings account or wallet.

- Don’t think about that for a year or certain months you would like to this challenge.

- Check out how much you were able to save at the end of your chosen month.

10. Envelop Challenge

This is a bit of a fun challenge to do.

Pros:

This challenge will require some envelopes. That’s why it’s called an envelop challenge. In this activity, we’ll use 20 envelopes. But you can add or lessen it if you want. Check out the example below and how to do this.

- This is fun because you don’t know exactly how much you need to save every month or every payday.

- You can adjust the amount based on your salary.

Cons:

- Like the other ipon challenges, it might be harder to save the higher amounts.

How to do it:

- Buy 20 envelopes.

- Write down the amount below on paper and cut them equally. Put each number individually inside your envelopes.

| 100 | 1100 |

| 200 | 1200 |

| 300 | 1300 |

| 400 | 1400 |

| 500 | 1500 |

| 600 | 1600 |

| 700 | 1700 |

| 800 | 1800 |

| 900 | 1900 |

| 1000 | 2000 |

- Reshuffle and keep the envelopes somewhere safe. Then, every time you receive your salary, pick one envelope and put the exact amount you picked inside the envelope, or you can save it directly to your savings account.

- Set aside the envelope you already picked and continue picking an envelope every payday until you no longer have any envelopes left.

- If you follow the table above, then you should be able to save a total of Php. 21, 000.00 by the end of the challenge.

- Move your savings to your savings account, then repeat if you still want to continue saving using this method.

Conclusion

There are a lot of ways we can save money. We just really have to find out what works best for us. These ipon challenges are just one fun way to start saving money.

They are also flexible, so you can always change the amount a little bit based on how much you can really afford to set aside. These ipon challenges can adjust based on your income. You can also combine two or more of the mentioned challenges.

Aside from doing ipon challenges, you can also explore budgeting methods that can help you save more money.

No matter what you choose from our list, we hope you get to enjoy doing it.