The investing world can be complex and intimidating for anyone just starting.

I may be lucky to have had investing as one of my subjects in college, but it’s a big question mark for those who finished a course far from finance-related courses.

But even if we did have an investing subject, we still need to study and understand investing.

This guide will break down the basics of investing in the Philippines, equipping you with the knowledge. Hopefully, you will be confident enough to invest after reading this article.

What is Investing?

Investing is committing money or capital to an asset or financial instrument with the expectation of generating income or profit over time.

These assets can be tangible, like real estate or precious metals, or intangible, like stocks and bonds.

Why is it Important?

You can achieve various financial goals by putting your money to work through investing.

It allows you to do the following.

- Grow your wealth

What do we mean by this?

Growing your wealth simply means it will increase whatever money you have if you invest it. Let’s say you have savings, and instead of just putting it in the bank, you’ll invest it to earn some interest higher than what you normally get from the bank, which is normally .05% for most commercial banks.

If you invest it in an investment fund that will earn you more than the inflation rate, you can increase your money or wealth.

- Meet financial goals

We all have dreams or goals, and normally, it takes time for us to achieve them, but we can not just depend on our savings, especially if we save a small amount of money every payday.

So, to achieve our goals faster, we will need to save for it, but make sure you save it somewhere where you can earn a higher interest as well.

Depending on your investment goal, you have to understand how many years you will keep your money without touching it or how long your goal is.

By understanding this, you will also know where to put your money. An example of a low-risk investment you can start is the MP2 Savings; the interest rate here varies from 4%-7% per annum, but you have to ensure you will not need it in the next five years because the holding period is five years for MP2 saving. You can read our MP2 guide to understand this better.

So, if your goal is for your kid’s education, how long before your kid reaches college? If it’s longer than five years, then you can save in your MP2, reinvest it after five years, and keep adding more.

- Secure your future

We never really know what the future brings, and of course, we wish for the best, but talking about the future, we might be talking about our retirement age. Or unexpected events like a pandemic, having an investment will make us more confident that we at least have something we can rely on in whatever circumstance that’s waiting for us.

Building a strong investment portfolio can provide financial security and peace of mind in the future.

Types of Investments

The Philippines offers diverse investment options to suit different risk tolerances and financial goals.

Here’s a breakdown of some of the most common types:

Stocks

So, what are stocks?

A stock is a financial instrument representing ownership in a company or corporation.

When you purchase a stock, you become a partial owner of a company. The value of your investment fluctuates with the company’s performance.

Stocks offer the potential for high returns but carry a higher risk.

You can understand more about stocks in our Stocks guide for beginners.

Bonds

Another type of investment is the bonds.

Bonds are loans you make to a company or government. In return, you receive regular interest payments and the return of your principal amount at maturity. Bonds generally offer lower risk and potential returns compared to stocks.

Mutual Funds

This is one of my favorite types of investment, mutual funds. You can read more about mutual funds through our Mutual Funds guide.

Generally mutual funds pool money from multiple investors and invest it in various assets like stocks, bonds, and commodities. This diversification helps to spread risk and provides a convenient way to invest in a mix of assets.

Unit Investment Trust Funds (UITFs)

Similar to mutual funds, UITFs invest in a basket of securities. However, UITFs have a fixed investment portfolio that doesn’t change throughout the investment period.

Real Estate

Real estate is another type of investment that other people venture into. This will require a lot of study if you want to get into this type of investment.

Investing in real estate can be done through direct ownership of properties or by investing in Real Estate Investment Trusts (REITs).

Real estate offers the potential for rental income and capital appreciation but also requires significant upfront capital and ongoing maintenance costs.

Considerations when Choosing an Investment

There are different factors you have to consider before choosing which investment you should take.

Here are three key factors to guide your investment decisions:

- Risk Tolerance

Risk tolerance is how comfortable you are with potential losses.

We have to be honest in every investment. There is always a chance of losses. You can never do away with that. That’s why you need to study the investment before you get into it.

If you are an investor with a higher risk tolerance, meaning you are willing to lose a higher amount of your investment, you can consider stocks and other growth-oriented investments.

If you are an investor seeking lower risk or don’t want to lose a lot of money from your capital, then you may prefer bonds or money market instruments.

- Investment Goals

Another important thing you have to consider is your investment goals.

This is your why in investing. Why do you want to invest? What do you want to achieve? What are you saving for? Ask these questions to yourself.

Investment goals can be short-term, this means you need your money back and your earnings within a couple of months or this year or less than 12 months. So if it’s a short-term goal, then you have to choose lower-risk investments like bonds.

Now, if your investment is for a long-term goal, which means you can leave your money for a longer period of time, like for retirement or your child’s education if you have a newborn child, then you can aim for investments with higher growth potential such as stocks and real estate, but of course, they also have a higher risk.

- Investment Timeframe

Invest timeframe is another big factor. This is asking yourself how long you plan to invest your money.

Long-term investments can withstand short-term market fluctuations, while short-term investments need to be readily accessible for your upcoming needs, so you have to choose the right investment type for this.

These factors work together, and you have to think about all these things before choosing which investment to take.

By considering these factors, you can create a personalised investment strategy that aligns with your risk profile and financial objectives.

How to Start Investing in the Philippines

Now that you know the types and considerations you must consider before starting your investment,

let’s discuss some practical steps for starting as a beginner investor in the Philippines.

Opening an Investment Account

The first step is to choose a platform through which to invest. Here are the main options available:

- Online Brokers

Online brokers offer convenient and often commission-free trading platforms to buy and sell various investments like stocks and mutual funds. Popular online brokers in the Philippines include COL Financial, First Metro Securities, and TD Ameritrade Philippines.

- Traditional Banks

Many banks in the Philippines also offer investment services, allowing you to invest in mutual funds, UITFs, and other instruments. This can be a good option for those who prefer a familiar and established institution.

Making Your First Investment

You can start with a large sum if you are starting with Real Estate.

Many online brokers in the Philippines allow you to begin investing with minimal amounts, sometimes as low as Php 1,000.

COL Financial, for example, have a P1,000.00 minimum investment, and you can open an account with them already.

It is the same with BPI; their Investment also starts with Php 1,000.00 pesos, and you can normally start investing in mutual funds immediately.

Starting with a small amount also makes it easier to test the waters and build your confidence before committing larger sums.

Do Your Research

Before investing in any company or fund, conducting thorough research is crucial.

This may mean understanding the company’s financial health, prospects or plans, and overall market conditions.

Here are some resources to help you with your research:

- Philippine Stock Exchange (PSE): The PSE website (https://www.pse.com.ph/) provides valuable information on listed companies, including annual reports, financial statements, and stock price history.

- Securities and Exchange Commission (SEC): The SEC website (https://www.sec.gov.ph/) offers investor education resources and company registration information.

- Financial news websites and publications: Stay informed by reading financial news and analysis from reputable sources.

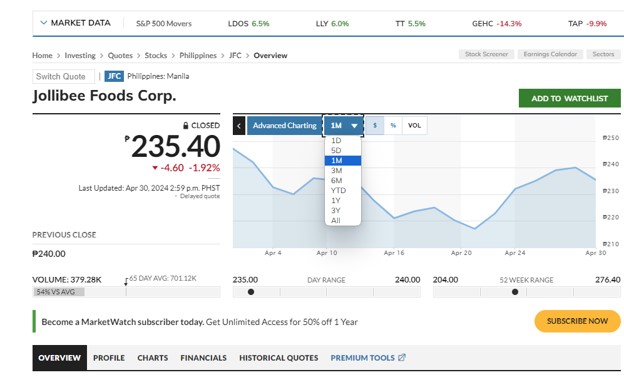

I also normally check sites like https://www.marketwatch.com/ to check past performance or price of a particular stock. For example, you can review Jollibee’s past performance by checking the website. Here’s the link to the example below: https://www.marketwatch.com/investing/stock/jfc?countrycode=ph.

It shows you how the price of the stock changes in a month. If you are interested in investing in Jollibee, you can directly buy stocks through your chosen broker, like COL. The code is JFC. We can explore the COL platform more in another blog.

Always remember investing involves risk, and past performance does not necessarily indicate future results.

Building a Strong Investment Portfolio:

Once you’ve made your first investment, consider these tips for building a well-rounded portfolio:

- Diversification

We all hear this: don’t put all your eggs in one basket. And this just means spreading your investments across different asset classes like stocks, bonds, and real estate to minimise risk.

- Invest Regularly

Develop a consistent investment habit, such as contributing a fixed amount monthly through a Systematic Investment Plan (SIP).

This helps you benefit from peso-cost averaging and ride out market fluctuations.

- Rebalance Your Portfolio

Periodically review your portfolio and rebalance it as needed to maintain your desired asset allocation.

You can build a strong investment foundation by following these steps and remaining disciplined.

Tips for Investment Success

Now that you’re equipped with the basics and initial steps, here are some valuable tips to help you navigate your investment journey:

- Set Realistic Expectations

The investment world is not a get-rich-quick scheme. Understand that market fluctuations are inevitable, and there will be periods of both growth and decline. Focus on building wealth over the long term rather than chasing short-term gains.

- Stay Informed

Continuously educate yourself about the financial markets and investment strategies. Read industry publications, attend investment seminars, and consult with financial advisors to stay updated on trends and opportunities.

- Beware of Investment Scams

Unfortunately, investment scams also exist in the Philippines. Be wary of unsolicited investment offers with unrealistic promises of high returns. Only invest through reputable institutions and conduct thorough research before committing your money.

- Seek Professional Help

Consider consulting a registered financial advisor (RFA) for personalised investment advice. An RFA can help you develop an investment strategy tailored to your needs and risk tolerance.

If you don’t know anyone, don’t have a budget, or just want to start small, you can watch video guides on YouTube or join investment webinars. COL, for example, has regular webinars where you can learn more about investing in different types of investments. You can visit their website to see their guides and schedules.

Other Investing Opportunities

The Philippines presents unique investment opportunities for its citizens. Here are some areas to consider:

Infrastructure Development

The government is investing heavily in infrastructure projects, creating opportunities for construction, materials, and engineering companies.

Consumer Goods

The Philippines has a growing middle class with increasing purchasing power. Investing in companies catering to this segment can be lucrative.

Renewable Energy

The Philippines has a strong push towards renewable energy sources. Investing in solar, wind, and geothermal power companies can be a sustainable and profitable option.

FAQs

What is the minimum investment amount in the Philippines?

The minimum investment amount varies depending on the platform you choose. Some online brokers allow you to start with as low as Php 1,000, while traditional banks might have higher minimums.

What fees are associated with investing in the Philippines?

Various fees are involved in investing, including brokerage commissions, transaction fees, and fund management fees (for mutual funds and UITFs). It’s crucial to compare fees between different platforms before opening an account.

What taxes do I need to pay on my investments?

Capital gains tax is levied on profits earned from the sale of stocks. Dividends received from Philippine companies are also subject to withholding tax. For the latest tax regulations, consult the Bureau of Internal Revenue (BIR) website (https://www.bir.gov.ph/).

Conclusion

The Philippines offers a dynamic investment landscape with exciting opportunities to build wealth.

By taking the first step towards investing, you’re empowering yourself to achieve your financial goals and secure a brighter future.

Remember, investing is a marathon, not a sprint. With discipline, education, and a long-term perspective, you can navigate the investment world successfully and unlock your full financial potential.