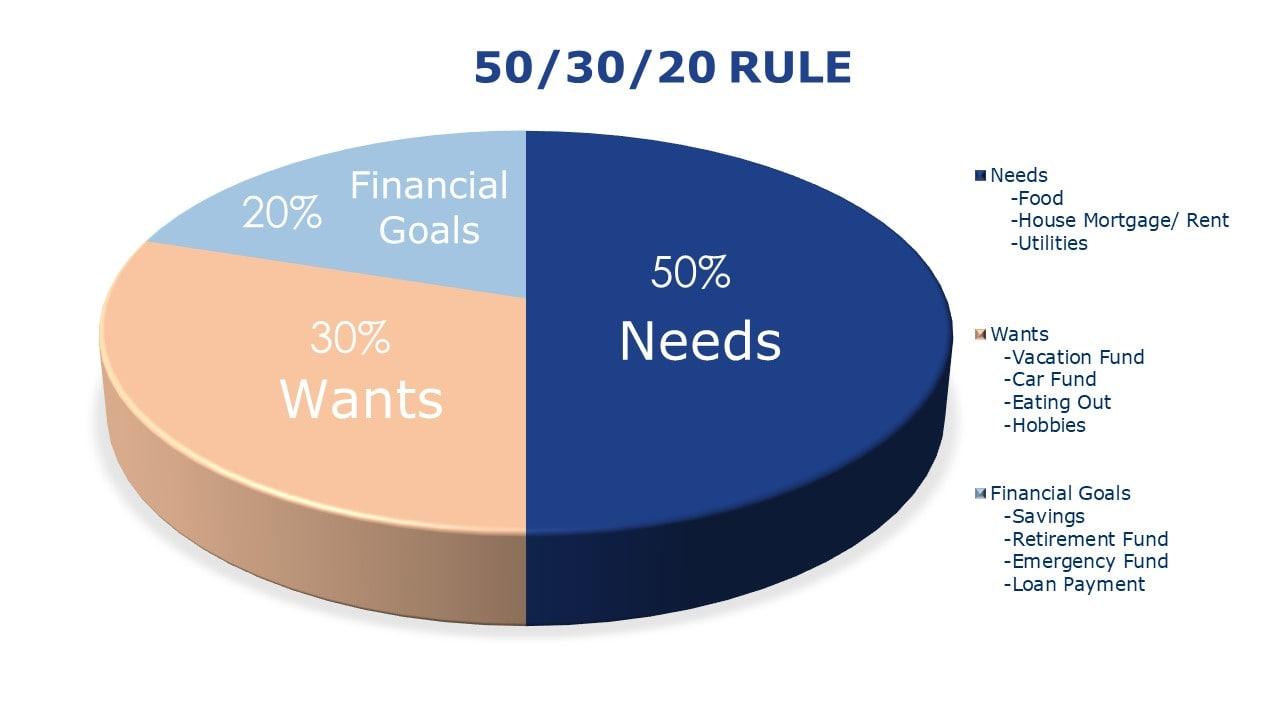

The 50/30/20 Rule is a simplified way of budgeting. If you find budgeting complicated and you think you need a guide or a certain rule to budget your money, then you can start with this rule.

Elizabeth Warren popularised this rule. She introduced it in the United States, but this applies to any country, including the Philippines.

How does it work?

The rule simply states that you should spend your income after tax and other mandatory contributions in three categories and with specific percentages. The computation will be 50% should go to your necessities, 30% on wants or leisure and 20% on your financial goals.

Where does your 50% go?

The 50% will go to necessities. Necessities are things that are necessary for survival. These are expenses or purchases we usually have every day or monthly.

These are:

- Food including water

- Shelter, so this will be for your house rental or house mortgage

- Utilities example Electricity bill etc.

Where does your 30% go?

The allocated income for your wants is 30%. Wants are the things that you can live without, such as:

- Vacation Expense

- Buying a Car

- To buy Fancy Clothes

- Restaurants

- Hobbies

Where should you put your 20%?

The 20% of your income can now be set aside for your financial goals.

- Retirement Fund

- Savings for other goals

- Emergency Fund

- For the Payment of your Debts

- Investments

That’s how you can allocate your budget using the 50/30/20 rule.

It’s pretty simple, right? You just have to decide where to allocate certain types of expenses you have daily.

Is the rule applicable here in the Philippines?

Yes, the 50/30/20 rule still applies here in the Philippines but may not apply to minimum wage earners. It would be hard to use this rule if you earn an income below Php. 50,000.00. Check the sample computation below.

The Rule is a simplified way of budgeting because it’s straightforward and easy to remember. You just have to identify your needs, wants and financial goals.

How to allocate your income based on the Rule?

Before allocating your income, you have to remove your tax and other mandatory deductions.

After this, divide your income based on the three sections, which are your needs, wants and financial goals.

To give you a clearer picture of how to do this, check out these two examples.

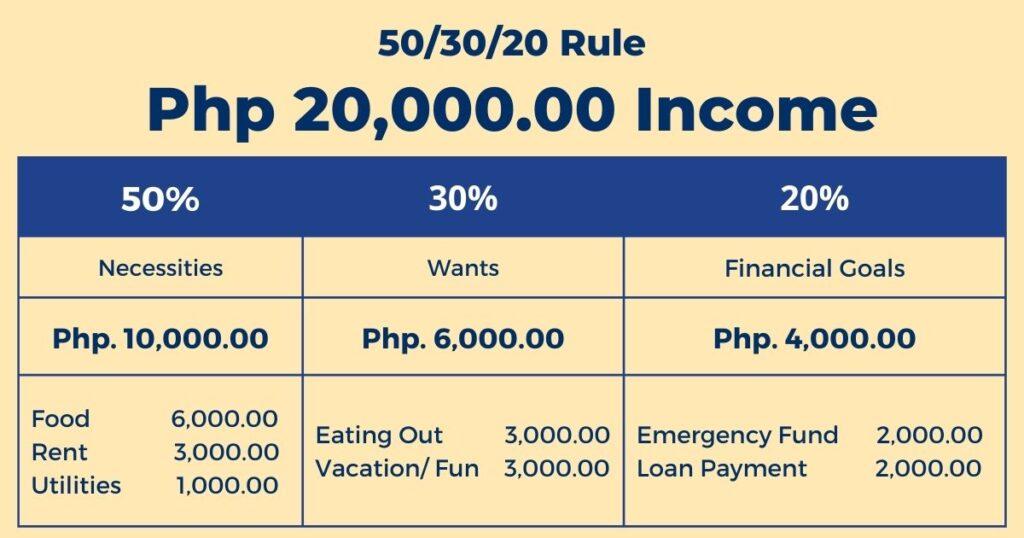

Example 1: Computation for Php 20,000.00 Income

Suppose you are earning twenty thousand pesos (Php. 20,000.00) monthly. Here’s a sample computation using this rule.

If we will put 50% of your income into Necessities. The 50% of Php20,000.00 is Php10,000.00 allocated to food, rent and utilities. So below is how it’s going to be budgeted

In this example, the six thousand pesos budgeted for food may not be enough, especially if you have kids or even if you are single, depending on where you are. The amount for the rent may not be realistic as well for a family with kids.

With this alone, you can see that it’s more realistic to move your 30% to your necessities instead of putting up an amount for leisure. I think the 20% can be set aside for savings or loan payments, but the 30% for wants is unrealistic with this income level.

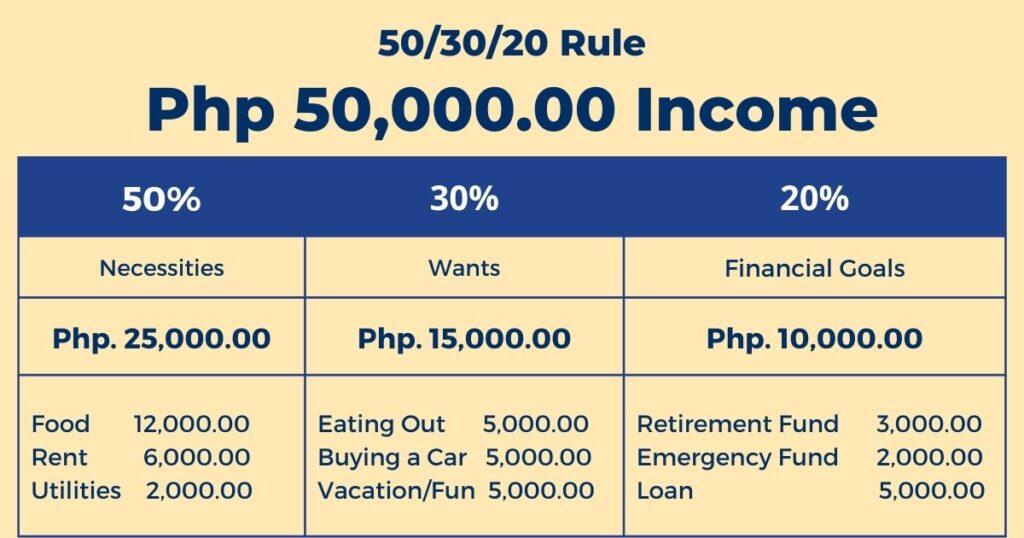

Example 2: Computation for Php 50,000.00 Income

Note that this is just a sample computation. You can adjust this according to your needs, wants and saving goals.

In allocating your budget, you have to consider your location and number of family members for the budget, especially for the food budget.

In these two sample computations, you can see exactly how you can allocate your income according to your needs, wants and financial goals.

Modifying the 50/30/20 Rule to Fit your Income

Based on the illustration above, the 50/30/20 rule may not apply to typical Filipino households, but you can modify it based on your income and priorities.

I think what makes the 50/30/20 rule work is its simplicity. You can set a 70/20/10 rule if you think that’s how you can cover your needs based on your income. So, if you want a simplified version like this, you just have three options for putting your money.

If your income is higher, you can apply the same rule or start with the 50/30/20 rule at first and slowly modify it based on what’s working for you. This rule is a good starting point if you struggle to manage your finances.

Where should you categorise your Church tithes and offerings with this Rule?

With the 50/30/20 rule, you can categorise your tithes under necessities or wants.

Depending on your faith, usually for tithes, it’s 10% of your income. So, you can get 10% of your budget from necessities or wants.

Another option is to deviate from the 50/30/20 rule and add another section to make it automatic on your budget.

You can add one more section for tithes which is 10%, so that will make the rule 50/20/20/10. If you divide your income this way, you can automatically remove the 10% tithe every time you receive your pay.

As for the other needs, such as offering and love gifts, you can get them from your wants or needs budget. Take note of these amounts and see where you can include them.

Conclusion

Having the rule to follow like the 50/30/20 is sometimes essential for us to be appropriately guided and make things easier. I heard our minds usually work best if we have three options, so that’s probably where this rule is based.

We can always follow the rule if it applies to our income level. If we think we need to make some adjustments, then we are always free to do so as long as we can make it work for our good.

No matter what rule you want to follow, I think what is essential is to understand your needs and wants and adequately budget your income.

You can always find other rules online as a guide and modify them according to what’s working for you.

Whatever you choose to follow, don’t forget to include savings in your budget because that’s what you need to start, no matter how small, to achieve your financial goals.

I wish you luck on your budgeting journey.